MORNING AG OUTLOOK

Grains are lower. Risk on risk off. US stocks are lower, US Dollar is lower. Crude is lower. Gold is lower. Most commodities are lower. One Fed speaker said rate cut still some ways down the road.

SN is near 12.35. SN-SX spread near +28. Heavy rains continue in S Brazil. Brazil soybean premiums are higher on increase China buying and lack of farmer selling. One analyst est Brazil and Argentina soybean combined crop at 197 mmt down 7 mmt from USDA. US soybean exports are down 18 pct vs ly and USDA 15 pct drop. China has still not bought US new crop soybeans. US soybean export price have narrowed gap vs Brazil. Brazil farmer good seller of soybeans, USDA est soybean plantings are 52 pct a 17 pct increase from last week. Furthest ahead of average is AR and ND. Furthest behind IL, NE and MI. Current conditions suggest the 52 bpa crop.

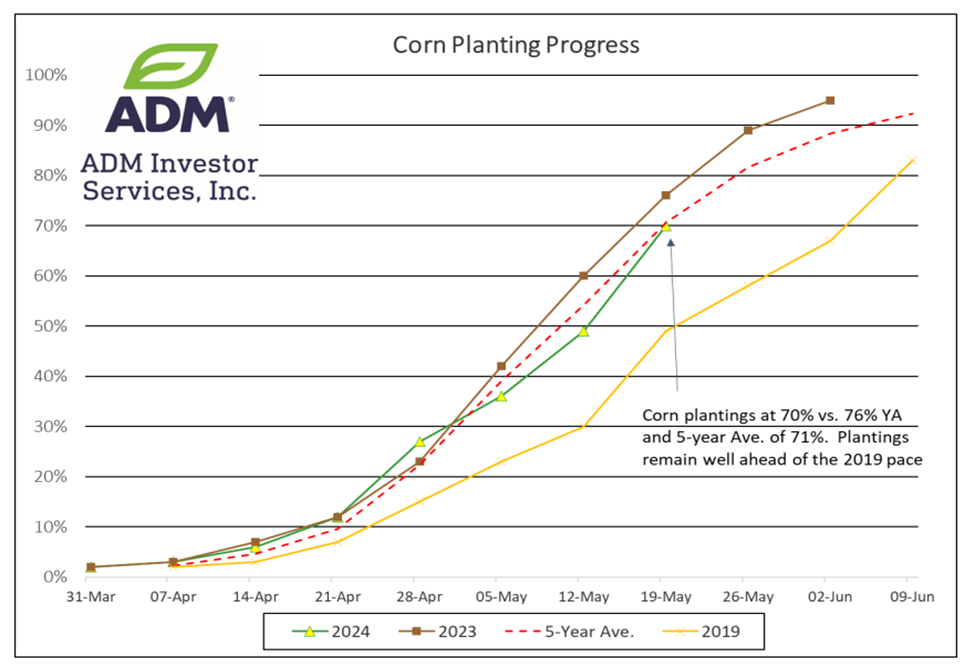

CN is near 4.56. CN-CZ spread -25. Some feel Mexico drought could increase their corn imports. US corn plantings were 70 pct. Wet US Midwest weather could slow plantings. 10-12 million acres will be planted after May 20. This could increase risk for summer dryness and heat. Increase Russia advance into east Ukraine could raise question about Ukraine corn exports. One analyst est Brazil and Argentina corn combined crop at 197 mmt down 16 mmt vs USDA. Current conditions suggest the 179 bpa crop. US corn exports are up 29 pct vs ly and in line with USDA est. Corn rallied following wheat, good weekly US exports and dry Brazil and Mexico.

WN is near 6.82. WN pushed through 6.75 resistance. Wheat futures were supported by dry US HRW and Russia forecast and wet EU winter wheat crop worries. US wheat exports are 60 mil bu behind USDA. C KS farmer reported hail damage and 100 mph winds lower his crop. USDA est spring wheat plantings at 79 pct. Winter wheat rated 49 G/E vs 31 ly. IL ratings down 7 to 70 pct G/E, KS 33 up 2, WA 43 down 3.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.