MONTHLY FUTURES MARKET OVERVIEW

>>Read the full August 2024 Edition HERE

GRAINS

The August 24 USDA data was neutral to slightly supportive for corn prices. Old crop 2023/24 ending stocks fell 10 mil. bu. to 1.867 bil., which was slightly below expectations as exports were raised another 25 mil. to 2.250 bil. with FSI usage cut by 15 mil. U.S. 2024 production rose 47 mil. bu. to 15.147 bil., which is roughly 35 mil. bu. above expectations. Yields increased to a new record high at 183.1 bpa, while harvested acres were cut 728k to 82.710 mil. Offsetting the higher production was a 60 mil. bu. increase in demand allowing ending stocks to slip to 2.073 bil., which is 25 mil. below expectations. New crop exports were raised 75 mil. to 2.30 bil., while FSI usage was cut 15 mil. The average U.S. farm price for 2024/25 was cut $.10 to $4.20 bu. Global stocks are forecast to fall 1.5 mmt to 310 mmt, which is nearly 1 mmt below expectations.

The August-24 USDA data and weather forecasts are bearish for soybean prices. Old crop 2023/24 ending stocks were unchanged at 345 mil. bu., which was in line with expectations. There were no changes to the old crop soybean meal balance sheet. In soybean oil, usage for biofuel production fell 100 mil. lbs. to 12.9 bil. lbs., which was offset by a 100 mil. lbs. increase in exports leaving stocks unchanged at 1.612 bil. 2024 U.S. production rose 154 mil. bu. to a record 4.589 bil. 120 mil. bu. above expectations. Yields increased to a new record high at 53.2 bpa, while planted acres actually increased 1 mil to 87.1 mil. The biggest increases were SD up 350k, MO up 300k, and OH up 200k. Slightly offsetting the higher production was a 25 mil. bu. increase in exports, resulting in ending stocks growing to 560 mil. bu. 95 mil. above expectations. The average U.S. farm price for 2024/25 was cut $.30 to $10.80 bu

All U.S. wheat production at 1.982 bil. was down 26 mil. from last month and at the low end of expectations, however, still an 8-year high. Winter wheat production was increased 20 mil. to 1.361 bil. at the high end of the range of guesses. By class changes were HRW up 13 mil. to 776 mil., SRW down 2 mil. to 342 mil. and white up 9 mil. to 243 mil. The biggest surprise vs. expectations was the 34 mil. bu. drop in spring wheat production to 544 mil. vs. expectations for a 4 mil. bu. increase. As a result of the lower than expected production, U.S. stocks are forecast to drop to 828 mil. down 28 mil. from July-24 and 34 mil. below expectations. World stocks at 256.6 mmt were in line with expectations. 2024/25 production was cut 2 mmt in the EU to 128 mmt, while Ukraine was raised 2.1 mmt to 21.6 mmt and Australia increased 1 mmt to 30 mmt.

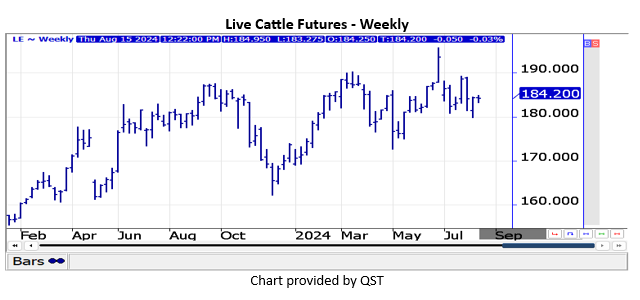

LIVE CATTLE

The July 4, 2024 holiday was a boon for cattle and beef prices. Throughout June 2024 prices increased as consumers bought beef for the holiday. However, when the holiday was over, there was a downturn. Boxed beef prices plummeted in July. On July 5 the cumulative choice beef price was $330.43. a week later the price fell to $322.06. By month end, choice beef was down to $312.79. Cattle slaughter was also down. The week before July 4 the weekly federal slaughter was 620,000 head. Naturally, with fewer days in the week including July 4, slaughter was down to 522,000 head. The week after as beef prices dropped on a full 5-day slaughter schedule, it was 601,000 head, followed by 584,000 head, then 600,000 head and ending the month at 593,000 head.

LEAN HOGS

U.S. federal hog slaughter for 2024 on July 31 was up 1.2% to 924,672 head. For the same period in 2023 hog slaughter was up 1.3%, at 936,000 head from 2022. The CME lean hog index was $93.53 on July 31, 2024 and the CME pork index was $105.64. On July 31, 2023 the lean hog index was $105.90, and the pork index was $114.61. Strong pork exports may have kept hog and pork prices from falling more than they did in 2024.

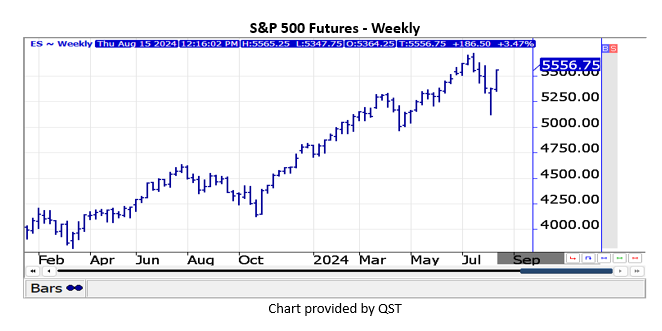

STOCK INDEX FUTURES

Stock index futures advanced on news that retail sales in July increased 1.0% when up 0.3% was expected, and the jobless claims number was a little less than anticipated. These reports eased investors’ concerns about a potential recession in the U.S. Other reports were not quite as supportive, including the August Philadelphia Federal Reserve manufacturing index, which was negative 7.0 when 5.8 was forecast and industrial production in July, which was down 0.6% when a decline of 0.1% was forecast. The August housing market index was 39 when 42 was estimated.

US DOLLAR INDEX

The U.S. dollar index has been trending lower since the last week in July. However, the technicals are improving now that futures have advanced above a steep downtrend line. In addition, the fundamentals may be improving, as well in light of the better than expected increase in July U.S. retail sales. There has been some flight to safety flow of funds into the greenback in light of the escalating tensions in the Middle East.

EURO CURRENCY

The euro currency trended higher in August despite investors slightly increasing their expectations for two European Central Bank interest rate cuts by mid-October. Limiting gains, however, is a recent report that showed a sharp drop in investor confidence and a surprising decline in industrial activity across the euro zone. Euro area gross domestic product increased 0.3% in the second quarter, which is unchanged from the previous quarter and matched preliminary estimates.

CRUDE OIL

Crude oil futures have been firm in August, driven by reinforced expectations of U.S. interest rate cuts, which could bolster economic activity and demand for crude oil. This came after tame U.S. inflation data, including consumer and producer price indexes. Additionally, investors remain anxious about the potential for supply disruptions in light of the potential for an escalating conflict in the Middle East. Limiting the gains are lingering demand concerns.

GOLD

Gold futures have remained strong despite the growing belief that the Federal Reserve may be less aggressive when it pivots to accommodation. This belief was enhanced when the U.S. retail sales report for July came in stronger than expected, and jobless claims were less than traders anticipated. Central banks continue their strong pace of buying gold, while the bullish flight to quality influence continues to underpin the market.

Interested in more futures market commentary? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.