CLOSING COMMENTS

Macroeconomics:

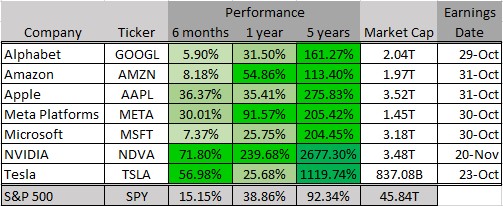

The US equity market is buckling up for an important earnings week, next week. Five of “The Magnificent Seven” companies will report third quarter earnings. “The Magnificent Seven” stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. A Bank of America analyst was the first to use the nickname in 2023 when describing stock performance for the group. The impressive performance of these seven stocks is driven by tech innovation, financial performance, market dominance, global economic conditions, brand equity, and R&D. Tech stocks used to be viewed as a risky investment but many today look at these seven an believe they will outperform most investments even through a recession.

Ag Fundamentals:

The row crop complex is red across all commodities today as we head into the weekend. Rains across the US growing regions has slowed the last 20% of corn harvest, but because we are so ahead of pace it should not become a huge concern. The USDA reported a sale of 116K MT of beans to China and a sale of 136K MT of corn to Mexico . Since Monday this week, the US reported flash sales like these totaling 1.347M MT of beans (49.5 million bushels) and 628K MT of corn (24.7 million bushels). Bean sales reported to mostly China and unknown and corn mostly to Mexico, Japan and unknown.

Weather:

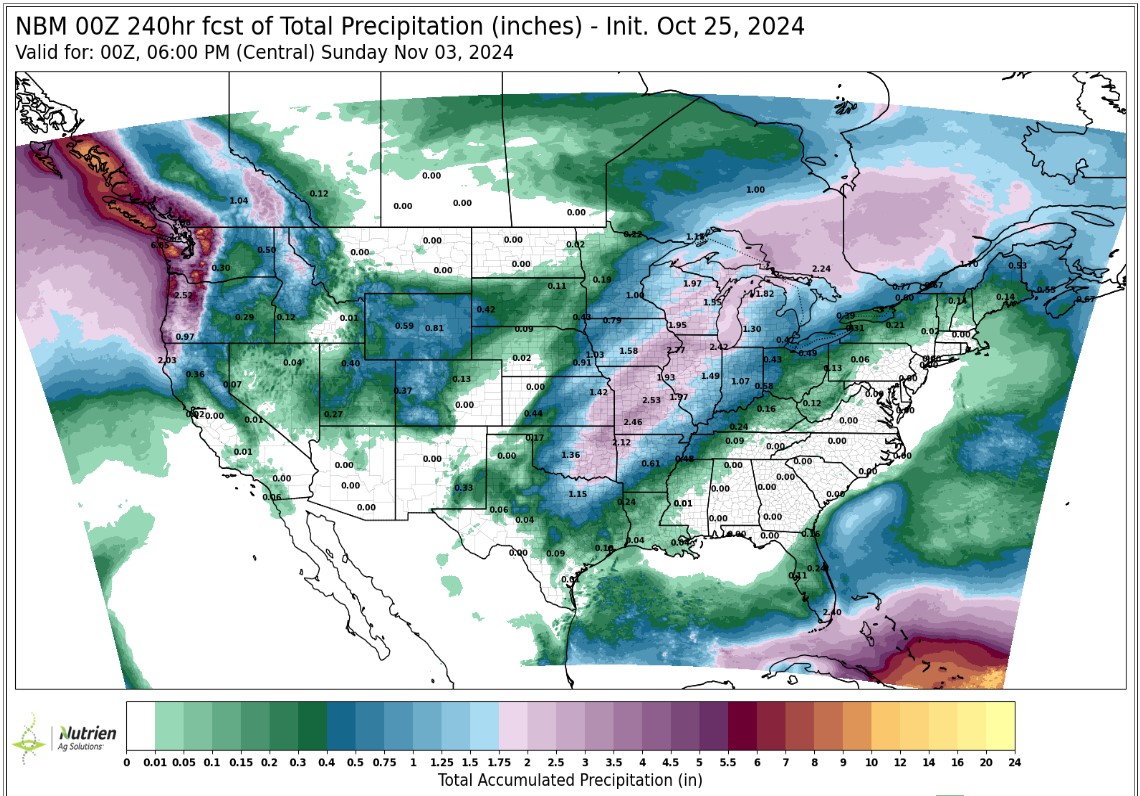

Rains across the Northern Plains, Midwest and into the Great Lakes region will give some farmers a nice break from a non-stop harvest. The 10-day forecast (image below) shows 1-2 inches of rain can be expected in the heart f the US. South America can expect to see rain coming across the central growing regions between now and the first week of November. No major weather concerns today for South American Farmers, but northeast Brazil and northern Argentina/Paraguay are missing some of these early rains.

“The Magnificent Seven” are listed below with their performance and scheduled earnings date. 5 out of the 7 will report earnings for Q3 next week and it may cause some volatility in the equity market.

The Next 10 Day Rain Forecast has folks dusting off their umbrellas for a shot of 1-2 inches of rain between now and November 3rd.

Calendar Spreads

|

Cost of Carry

Spreads are weaker today. Corn makes sense, we still have 20-25% left to harvest and most on-farm storage was packed with beans. So corn has a lot less resistance to delivery than beans. Bean spreads back off as options expire and the spread squeeze seems to settle with a shift in positions.

>>Interested in more commentary by Joe Mauck? Go HERE

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.