SOYBEANS

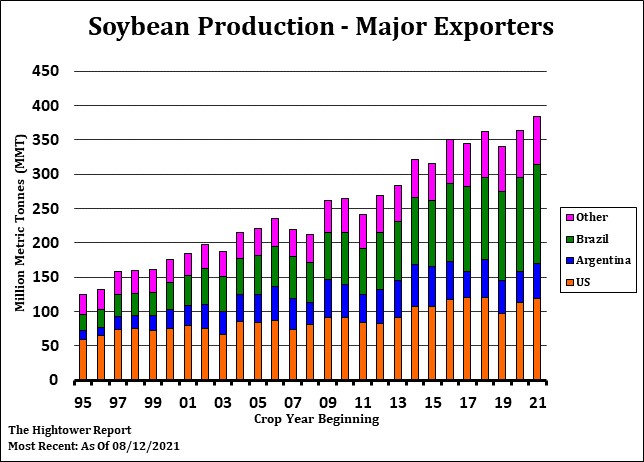

Soybeans tried to bounce higher from an oversold position. Funds were small net buyers after weekly US soybean export sales were higher than expected. Some feel US September soybean sales pace could remain below last year but pace could improve Oct and Nov. SX ended near 12.83. This week there was talk of a few traders beginning to buy SX-SX2 if China buying improves and US farmer is a reluctant seller at harvest. Since the hurricane, SX has dropped from 13.36 to a low near 12.70. SX took out support near 13.00 and 12.75. 200 day moving average is near 12.55. Fact most US gulf elevators are not loading vessels due to loss of power helped trigger the selloff. New crop soybean sales were 2.1 mmt. China was 1.2 with .6 in unknown. China 21/22 commit is near 7.9 mmt with 6.3 in unknown. Their 20/21 commit was 36.0. USDA did announce today 126 mt new US soybean sales to China.

CORN

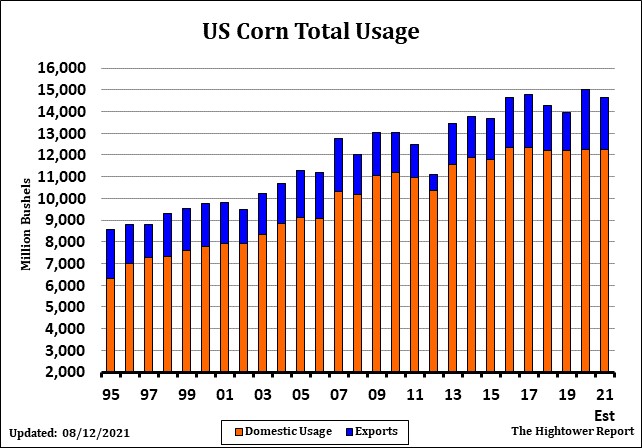

Corn futures continued its deep dive after US Hurricane damaged or loss power to US gulf export elevators. CZ has dropped from 5.58 to todays low near 5.16. Next support is near the 200 day moving average at 5.02. Corn futures found support after weekly US export sales were higher than expected. 20/21 corn export commit is near 2,756 mil bu vs 1,755 ly. New crop corn sales were 1.1 mmt. Total unshipped sales are near 20.4 mmt vs last year final commit near 44.5. Mexico, Colombia and Canada were the best buyers. China 21/22 is near 10.7 mmt. Their 20/21 commit was 22.6. Managed funds appear to be unwilling to increase net long positions until power is restored to US gulf export elevators, China begins to buy US corn, post USDA Sep 10 report and after US harvest. US farmer has sold more corn to date than average and may be a reluctant seller at harvest. Interesting to report that at this year Farm Progress show, IN and IA farmers feel USDA est of their states corn yield may be too high while IL farmers feel USDA may be too low. USDA will resurvey US corn acres on Sep 10. Some feel they could increase corn acres 1.0 million based on farmer crop insurance enrollment data. Brazil weather remains dry as farmers start planting their 2022 corn crop. Argentina rains has improved planting conditions there.

WHEAT

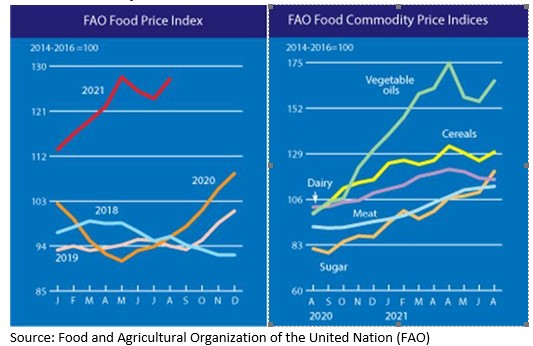

Wheat traded mixed. Wheat futures have been trading lower following lower trade in corn and soybeans. Weak technical prices action and lower Matif wheat futures also weighed on prices. WZ ended near 7.17 with a range of 7.05 to 7.21. WZ remains between 7.00 support and 7.40 resistance. Some feel tight World 2021 supplies could eventually push prices higher. KWZ ended near 7.08. Range was 6.98 to 7.11. MWZ ended near 8.99 with range 8.90 to 9.02. Fact World food prices continue to trend higher and Covid continues to spread could slow food demand. Wheat sales were 11 mil bu. Total commit is near 346 vs 452 ly. US SRW fob prices are near $304 vs US HRW $335, Baltic $302. Germany $305, Russia $305 and French $298. This week, Farm Futures est US 2022 all wheat acres near 49.7 million acres vs 46.7 this year. US south plains HRW weather could be drier than normal.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.