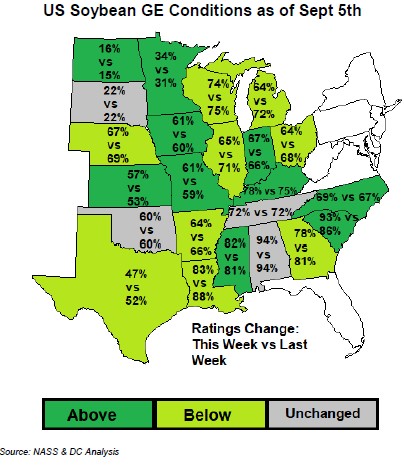

SOYBEANS

Soybean ended mixed. Trade still looking for a spark that could send futures higher. Fact US gulf export capacity is limited due to the Hurricane and backs up grain into the country remains negative. It also limits new export sales. Some hope that by next week electricity may be restored to all the elevators and damage can be assessed and repaired. Most feel Brazil and Argentina may be out of extra soybeans for export. China continues to need soybean to crush. On Friday, USDA will revise US 2021 soybean crop and adjust demand. Trade est US soybean yield near 50.4 vs USDA 50.0 and a crop of 4,377 mil bu vs USDA 4,339. Still, weekly crop ratings are below August 1 and last year. Best crops remain in KY, LA, MS, WI and TN. Lowest rated crops are in MN, ND, SD and IA. SX is on hold near 12.79.

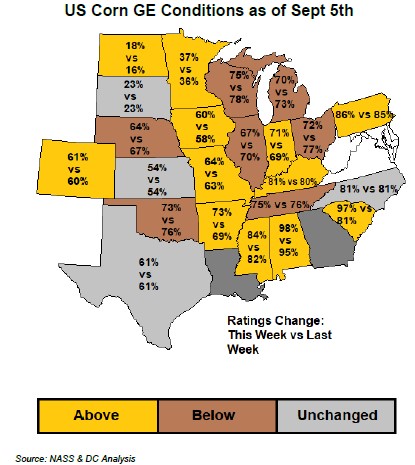

CORN

Corn futures were mixed. CZ ended near 5.10. CH2 ended near 5.19. CN2 ended near 5.26. CZ2 ended near 4.97. Some feel futures could remain under pressure through harvest and due to a lack of new export sales. Demand bears could see harvest lower near 4.80 CZ. US farmers remain reluctant sellers due to lower futures and lower basis. Some are looking for a rally in basis or narrowing of spreads to signal a harvest low or possible post harvest bounce. One US Gulf elevator is loading vessels. Rest are waiting for electricity. Some hope that electricity might be restored next week and elevators can access damage and begin repairs. Barge freight has rallied. This has dropped basis to farmers and slowed new cash sales. USDA dropped weekly US corn G/E ratings from 60 pct to 59. Ratings are below last year. Some feel USDA could drop the yield due to dry August. Others feel reports of higher yields where harvest is starting could suggest a higher yield. Trade est yield near 175.9 vs USDA 174.6, Trade also est US 20/21 carryout near 1,169 mil bu vs USDA 1,117 and 21/22 carryout near 1,382 vs USDA 1,242. USDA could also increase US 2021 planted acres. Most recent farmer crop insurance enrollment data suggest acres could be increased 1.0 million. Since the “bullish” August report CZ has loss 87 cents.

WHEAT

Wheat futures continue to slide lower. Higher than expected Canada July 31 wheat stocks trigger new selling. This followed a higher than expected estimate of Australia wheat crop. Canada what stocks were 5.7 mmt vs 4.8 expected and 5.5 last hear. Some rain in parts of Canada may slow harvest there. Russia wheat acres remain dry for the spring crop and planting of the 2022 winter crop. Nigeria bought US HRW. Some link this due to concern about EU quality. Egypt bought Ukraine and Russia wheat in their tender. WZ ended near 7.09. KWZ ended near 7.05. MWZ ended near 8.94. WZ remains in a 7.00 to 7.40 range. 5 pct of US 2022 Winter wheat crop is planted vs 3 average. Recent farmer poll suggested US all wheat acres could increase to 49.7 million vs 46.7 last year. Trade est US 21/22 wheat carryout near 616 vs USDA 627. Range was 579-652.Trade est World wheat end stocks near 279 mmt vs USDA 279. Non China and India stocks are near 111 mmt.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.