SOYBEANS

Soybeans ended slightly higher. New US sales to China and talk China is the largest short in soybean futures and cash offered support. Fact US soybean export commit is running behind last year and open US harvest weather offers resistance. SX traded over initial resistance near 12.96. Next level of tech resistance is near 13.31. Some could see soybean futures test 13.30 as a high then 12.70 SX21 as a OND average futures prices. Weekly US soybean export sales were 46 mil bu of which China was 34 mil bu. Total commit is near 819 mil bu vs 1,184 last year. Reduced US gulf export capacity may be slowing US soybean shipments and new sales. Some feel final US soybean yield could be lower than USDA Sep est. This could support higher futures. Soybean futures are in a carry until July,22 then large inverse into fall 2022.

CORN

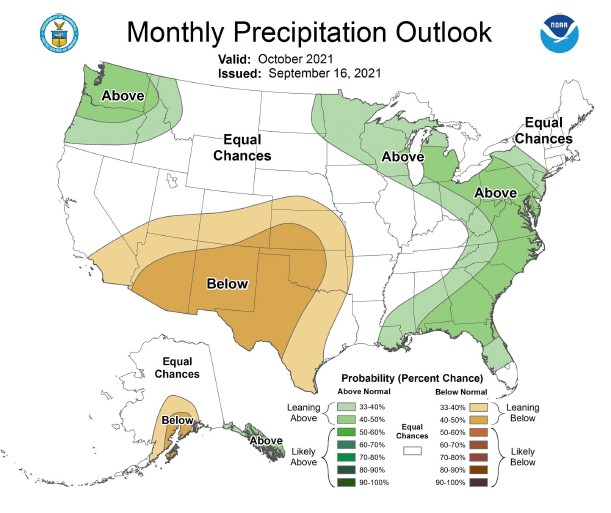

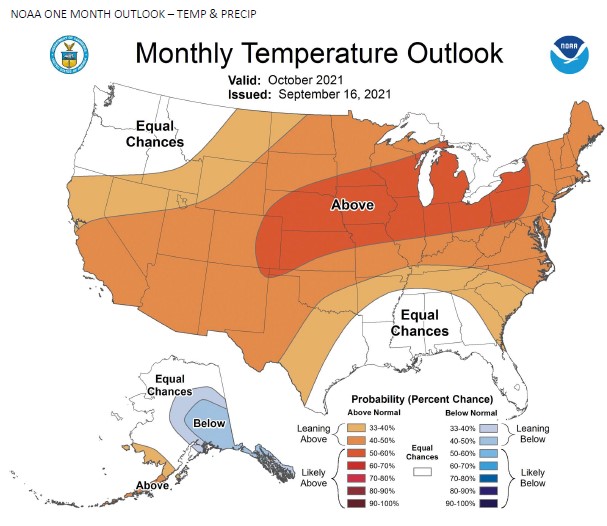

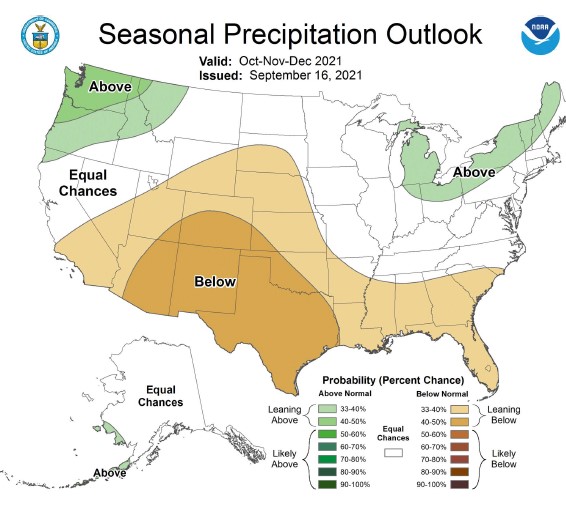

Corn futures ended lower on long liquidation before an active US Midwest corn harvest weekend. Some feel farmers will deliver on existing contracts but may not sell additional bushels. Farmer is bullish and in a good financial position. This could suggest a higher basis post harvest. Problem is that in 2022, World crop rebound futures may not rally enough to pay for storage. Corn futures are in a carry through March but steep inverse into CZ22. Weekly corn export sales were only 9 mil bu. Total commit is 967 mil bu vs 805 ly. China commit is near 11.9 mmt or 472 mil bu. There is 2.4 mmt or 95 mil bu in unknown. China has done a good job in pricing US corn early. Commercials still feel they will take 21 mmt or 830 mil bu of US corn. CZ ended near 5.29. CZ traded above the 20 day moving average but ended back below the price. Some could see nearby corn test 5.60 as a high and CZ21 5.35 as a OND average futures price. NWS US Midwest 30 and 90 day weather forecast suggest warm and mostly dry weather. This could speed up US harvest. This week, corn futures rallied in part on strong domestic corn basis and some talk that current US state by state crop ratings and dry end to crop growth could lower the final US corn yield as low as 168. This news triggered new Managed fund buying.

WHEAT

Wheat futures ended mixed. WZ ended near 7.13, KWZ ended near 7.20. MWZ ended near 9.06. Most of the wheat news is friendly. Managed funds are short. Final Canada wheat crop could be below 20 mmt vs 35 last year. This could drop exports below 16 mmt vs 26 ly. Today, Russia dropped their wheat crop with some as low as 70 mmt vs USDA 72.5 and 85.3 ly. USDA est Russia wheat exports at 35 mmt vs 38.5 ly. Some are as low as 26 mmt. Finally French crop is near 36 mmt but only 9 mmt may be million quality. Where will milling World buyers buy Wheat? US? Dry winter wheat planting weather in US and Russia could also add Weather premium to futures. Problem is that every 6 months they will be a new World wheat harvest. Some could see 2022 wheat crop higher with Canada, US, Russia and EU crops near 305 mmt vs 270 this year. Weekly US export sales were near 22 mil bu. Total commit is near 383 vs 482 ly.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.