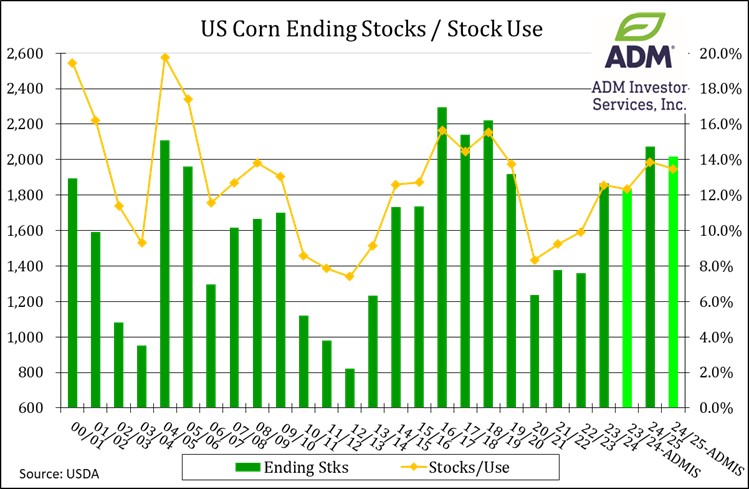

CORN

Prices were $.04-$.06 lower. After trading to a fresh 6 week high Dec-24 futures turned lower forming an outside day down closing right at its 50 day MA support. Export sales at 65 mil. bu. (-7 mil. – 23/24 MY, 72 – 24/25) were above expectations. Old crop commitments are still up 37% from YA vs. the USDA forecast of up 35%. Shipments are up 37%. New crop commitments at 442.5 mil. bu. are up 8% from YA vs. the USDA forecast of up 2%. Largest buyers last week were Mexico – 32 mil. and unknown – 19 mil. US net farm income is forecast to drop 4.4% in 2024 to $140 bil., much improved from the 26% drop forecast back in Feb-24. Prices may also have been pressured by talk Mexico may once again be trying to limited the amount of GM corn they import. For the soon to be completed 23/24 MY Mexico’s import commitments from the US at 890 mil. bu. represent nearly 40% of the USDA forecast.

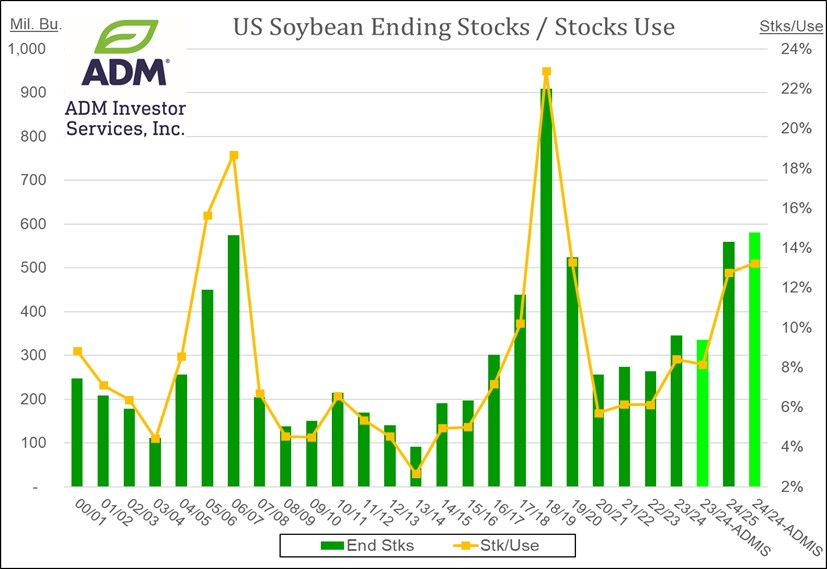

SOYBEANS

The soybean complex was lower across the board with beans down $.18-$.19, meal was $1-$2 lower while oil was clobbered down 135-155. Bean spreads were little changed and remain historically weak. After trading to a 1 month high, Nov-24 beans failed to trade above its 50 day MA resistance before moving lower. While held above the $10.00 level Nov-24 beans also forged an outside day lower. Oct-24 meal also traded to a 1 month high before pulling back. First support is at its 50 day MA at $314.70. Oct-24 oil has so far held support above $.40 lb. Spot board crush margins ended the week at $1.43 bu. with bean oil PV plunging to 38.5%, both at 2 month lows. Little change in US weather with much of the Midwest trending warmer/dryer than normal over the next 2 weeks. Both corn and soybean crops will be pushed toward maturity likely taking the top end off yield potential. Little rain is expected for key growing areas of SA thru mid-month. Dry conditions could delay the start of soybean plantings in WC Brazil, extending the window of US soybean sales in the global marketplace. Exports at 53 mil. bu. (-8 mil. – 23/24 MY, 61 – 24/25) were in line with expectations. Old crop commitments slipped to 1.670 bil. are down 15% from YA in line with the USDA forecast. New crop commitments at 434 mil. are still the lowest since 2019, down 26% from YA vs. the USDA forecast of up 9%. China/unknown combined to buy 54 mil. bu. of new crop last week

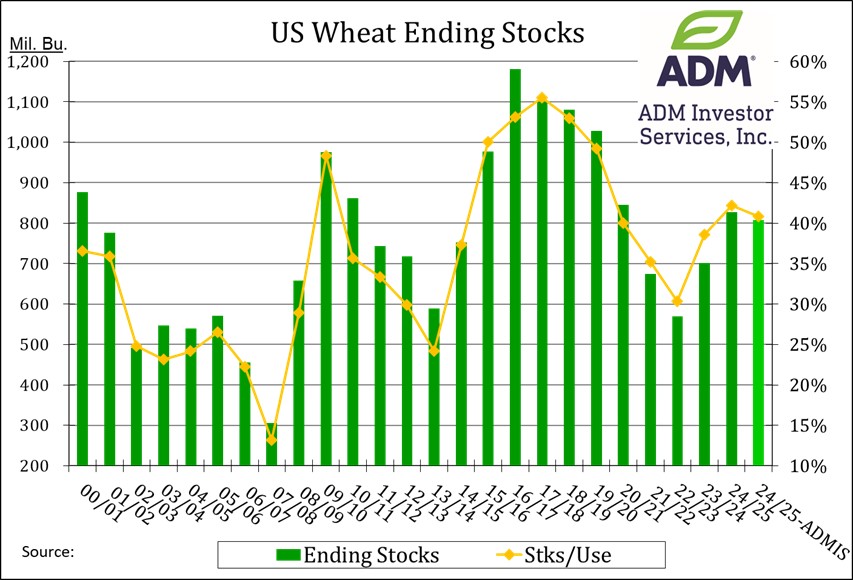

WHEAT

Prices slumped into the close finishing $.08-$.09 lower in Chicago while KC and MGEX were both off $.11-$.14. At the close Dec-24 futures for all 3 classes were all or just above their respective 50 day MA’s. Exports at 12.5 mil. bu. were at the low end of expectations. YTD commitments at 378 mil. are up 31% from YA, vs. the USDA forecast of up 17%. Commitments represent 46% of the USDA forecast, slightly below the historical average of 47%. YTD by class commitments are as follows: HRW +77% vs. USDA +79%, SRW -8.5% vs. -30%, HRS +18% vs. +8.5% and white +65% vs. +25%. The BAGE kept their Argentine wheat production forecast unchanged at 18.5 mmt, vs. the USDA est. of 18.0 suggesting recent rains have helped stabilize crop prospects. Russia cut their wheat export tax 19% to 906.4 roubles/mt in the period ending Sept. 17th. Their export price for wheat ended the week at $217/mt unchanged for the past few weeks.

Charts provided by USDA Charts.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.