SOYBEANS

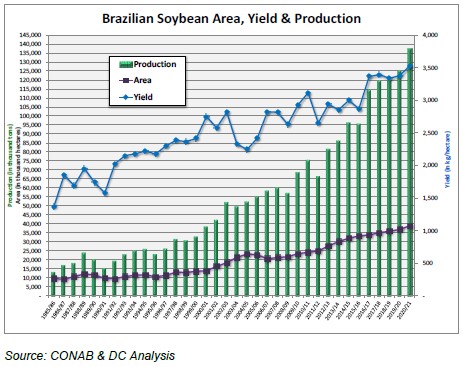

Soybean ended higher. Talk that China may have bought cargoes of US soybeans offered support. Soybean and soymeal domestic values are higher. Dalian soybean and soymeal prices traded higher. China soybean crush margins are positive. US board and cash soybean crush margins are also very high. Soybeans and most commodities are higher on talk of increase inflation. US October inflation data was highest in 31 years. Everyone sees higher prices at the gas pump and grocery store except WH and US Fed Chairman. Weekly US soybean export sales is estimated near 950-1,800 mt versus 1,864 last year. US soybean exports commit is running 34 pct behind last year vs USDA estimate of a 9.5 decline. Conab estimated Brazil 2022 soybean crop near 142 mmt vs 137 last year. US October NOPA soybean crush is est near 181.9 mil bu vs 153.8 in Sep and 185.2 last year.

CORN

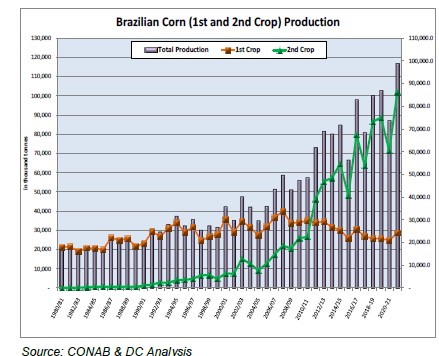

Corn futures were unchanged with CZ near 5.69. 5.79 was the session high. These prices are higher than end users had hoped before USDA November report. USDA World numbers were bullish with World corn exports stocks to use ratio historically low despite USDA adding 36 mmt to South America 2022 corn supply versus last year. USDA estimated combined World 2021/22 corn and wheat trade at a record 406 mmt versus 378 last year. Current prices are not slowing demand. Today, Conab estimated Brazil 2022 corn crop at 116 mmt vs 87 last year. Market rallied yesterday on news China was buying Ukraine corn. US corn prices to China are lower than Ukraine prices. Trade is still looking for final US corn demand 250 mil bu higher than USDA November guess. Corn, soybean and wheat prices are also competing for 2022 US acres. Higher cost of planting corn could lower US corn acres at a time of tight supply. CZ is gaining on CH22 with US corn processors raising basis to try to buy corn at a time of very positive margins. Weekly US corn export sales are estimated near 700-1,400 mt versus 1,864 last year. At some point tight global corn supplies and increase demand should help CH22 test 6.00. Any South America or US 2022 weather issue could send futures higher.

WHEAT

Wheat futures continues to trade higher. WZ and KWZ are both over 8.00. WZ ended near 8.13. High was 8.24. KWZ ended near 8.27. High was 8.38. Both new highs. Next resistance is 8.50 then 9.00. MWZ is back near 10.56. USDA November World numbers were bullish with World wheat exporters stocks to use ratio record low. EU and Russia need to slow exports. Matif wheat futures made new highs. Buyers are short and buying hand to mouth in hopes of lower prices. Drop in World Ocean freight is helping add to end user coverage. Increase US stimulus checks is increasing food demand despite talk of higher prices. Talk that long term US summer Midwest and south plains weather could be dry could also support wheat prices. Russia wheat areas are also dry and could also be dry next spring and summer. US wheat, oat, corn and soybean prices will need to remain competitive to buy 2022 acres. Brazil cleared the way to use Argentina wheat flour but not GMO wheat. This raises a lot of unknown. Brazil consumers may not want Argentina wheat flour. Australia wheat futures continue to trade higher due to wet harvest.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.