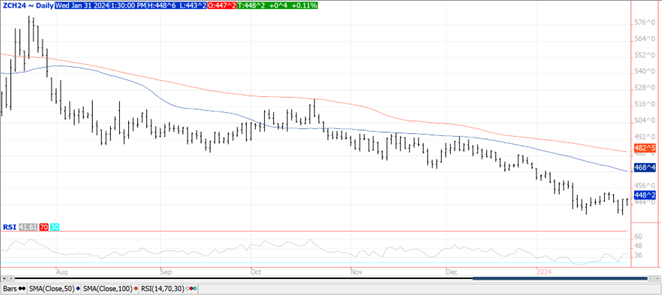

CORN

The late rebound enabled prices to close mixed with bull spreading noted. All contacts closed within $.01 of unchanged. Resistance for Mch-24 is at last week’s high of $4.53 ¼, followed by the 50 day MA at $4.68 ¼. Not much change in SA weather. Conditions in Brazil to remain mostly favorable despite net drying and heat in the southern and west central growing regions. Hot/dry for much of Argentina for at least another week. Crop stress will be most pronounced in southern growing areas. Ethanol production rebounded to 991 tbd last week, well above the 818 tbd pace the previous week, which was nearly a 3 year low. Corn usage reached 99 mil. bu. or 14.2 mil. bu. day, below the 14.7 mbd needed to reach the USDA usage forecast of 5.375 bil. bu. Implied gasoline demand improved 3% last week to 8.144 mbd, however was still down 4% from same week YA. After tomorrow’s close the USDA will release census data showing how much corn was used in the production of ethanol in Dec-23. Export sales tomorrow are expected to range from 32 – 48 mil. bu.

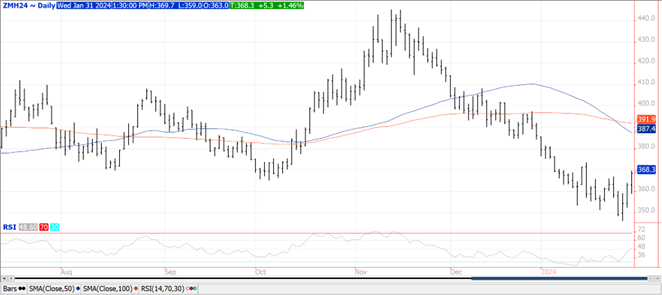

SOYBEANS

The soybean complex was mostly higher with beans up $.03 – $.05, meal was $3 – $5 higher, while oil was mixed closing within a few ticks of unchanged. Mch-24 beans managed to close above yesterday’s high, next resistance at last week’s high at $12.47 ½. Mch-24 meal closed at a 2 week high, next resistance at $373.60. Renewable diesel production rose 6% in Nov-23 to 224 mil. gallons, however still well below the record production of 251 mil. from Sept-23. Combined biodiesel and renewable diesel production however fell 1% to 384 mil. gallons as biodiesel production fell to a 7 month low. Both biodiesel and RD capacity was unchanged leaving the combined at 5.936 bil. annually. Production rates were at 77.6% of capacity, a 9 month low. Soybean oil usage for biofuel production was unchanged at 1.062 bil. lbs. an annualized pace of 12.74 bil. lbs., below the USDA forecast of 13.0 bil. Bean oil usage as a feedstock ticked up to 36.2%. Crush is expected to come in at a record high of 206 mil. bu., above the existing record of 201.5 mil. from Oct-23. Estimates range from 204 – 207 mil. Bean oil stocks are expected to jump 11% from Nov-23 to 1.764 bil. lbs. Despite the expected build, stocks would still be down 23.5% from YA levels of 2.31 bil. lbs. Oil stock estimates range from 1.73 – 1.875 bil. lbs. Export sales tomorrow are expected to range from 20 – 40 mil. bu. for beans, 200 – 450k tons meal, and -5 – 5k tons oil.

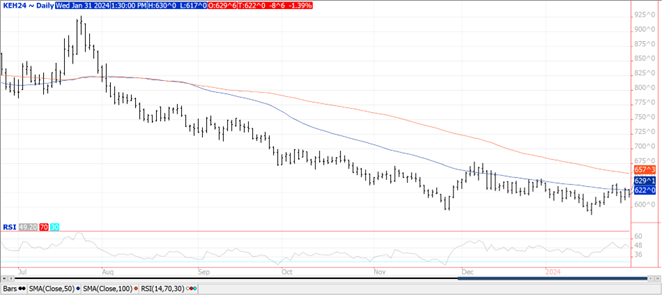

WHEAT

Prices were lower across all 3 classes today. Chicago and KC were both $.08 – $.10 lower, while MGEX was down $.06 – $.08. An inside trading day for Mch-24 Chicago with today’s high capped at its 50 & 100 day MA resistance. Same story for Mch-24 KC which is capped by its 50 day MA at $6.29. Heavy rains are expected for the US gulf coast and Delta region this weekend. Good rains are also expected to extend into much of KS and western NE. Russia’s Ag. Ministry raised their 2024 harvested acres forecast by 300k hectares to 84.5 mil. HA. Roughly 20 mil. HA of winter grains were planted last fall with 96% in Good to fair condition in December. Shipping sources indicate Ukraine’s January maritime ag. exports will slip to 3.8 mil. mt, down from 6.1 mmt in December. Export sales tomorrow are expected to range from 10 – 20 mil. bu.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.