CORN

Prices were $.04 – $.06 higher today with Mch-24 finishing above its Jan.12th close (USDA report day) for the first time. Next resistance is at $4.60 followed by the 50 day MA at $4.72 ¾. Prices were supported by a lower US $$, a surprise rate cut by China, and the need for additional SA weather premium. Speculative short covering with limited selling interest from farmers also played a major role with corn and wheat surging to new highs in late trade China cut their reserve requirement .5% to 7% in an effort to offer up $140 bil. in new loans. The Shanghai Index closed 1.8% higher as a result. US corn is offered at levels slightly below Argentina thru the end of Feb-24. March forward, Argentine corn is $10 – $15 below US thru the Spring months. The market has shrugged off the lowest ethanol production figure in nearly 3 years as the huge drop was likely due to frigid conditions across the nation’s midsection last week. Production fell to only 818 tbd, down from 1,054 tbd the previous week and down 19% from YA. Only 82 mil. bu. of corn was used in the production process vs. 103 mil. needed per week to reach the USDA corn usage forecast. Implied gasoline demand fell 3% LW to 7.88 mbd and was down 4.7% from same week YA. Ukraine’s Ag. Minister reports their grain exports so far in January have reached 3.7 mmt, up from 3.0 mmt YA. A breakdown of the grain exported wasn’t provided. Brazil’s corn exports in Jan-24 are expected to reach 3.86 mmt, down from 4.86 mmt YA. Export sales tomorrow are expected to range from 30 – 55 mil. bu.

SOYBEANS

Prices were mixed with beans closing within $.02 of unchanged with bull spreading noted, meal was up $2 – $3, while oil was 70 – 90 lower. Resistance for Mch-24 beans is $12.51 with support at $12.01. Mch-24 meal is at about the midpoint of its recent $351 – $374 range. Resistance for Mch-24 oil is at its 50 day MA, currently 49.76 with support at 46.30. Spot board crush margins slipped another $.06 to $.79 ½ bu. with oil PV dropping to 39.4%. Rains in Brazil over the next week will favor the NC and NE growing regions. Flooding is possible for areas of northern Minas Gerais, Bahia, and Tocantins with some 6+” rainfall totals possible. Lesser amounts are forecast for major production areas of Mato Grosso and MGDS. Little to no rain for Argentine crop areas over the next 10 days. Showers are forecast to return days 11 – 14 with distribution of these rains expected to be erratic. Moisture will be needed to relieve crop stress as temperatures rise to much above normal readings by early next week. Brazil’s bean exports are expected to reach 2.3 mmt in Jan-24, well above the .94 mmt in Jan-23. Conab reports Brazil’s harvest has reached 5% as of last Saturday. Beans in Mato Grosso (largest producing state) are 13% harvested with production forecast at 39 mmt, down 14% from YA. In Parana (2nd largest) harvest has reached 12%, while conditions in the state fell 3% LW to 61% good. Export sales tomorrow are expected to range from 25 – 48 mil. bu. of beans, 150 – 450k tons meal, and -5 – 10k tons of oil.

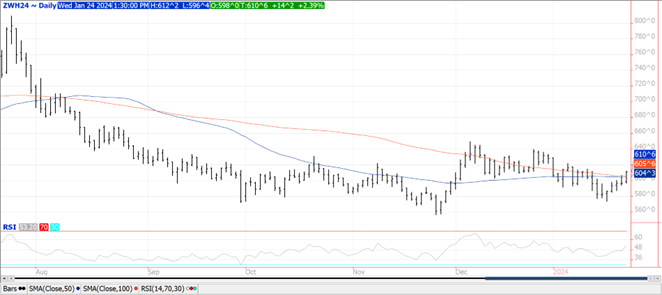

WHEAT

Prices were higher across all three classes today led by Chicago which was $.12 – $.14 higher. KC was up $.08 – $.09, while MGEX finished $.05 better. Chicago Mch-24 closed above both its 50 and 100 day MA’s, next resistance is $6.21 1/2. Next resistance for Mch-24 KC is its 50 day MA at $6.31. Rising tensions in the Black Sea region provided a late day boost as reports circulated of a Russian military plane crashing near the Ukraine border. Russia accused Ukraine of shooting down the aircraft despite reports many of the 74 people killed may have been Ukrainian prisoners of war. Heavy rains have battered the US Gulf coast and Delta the past 36 hours. Areas of east TX, LA, and AR have experienced localized flooding. Heavy rains will gradually shift east over the next 24 – 48 hours. Little moisture is expected in the northern plains and western corn belt with drought conditions likely to deepen a bit. Jordan passed on making any wheat purchases for their recent tender for 120k mt of milling wheat. SovEcon if forecasting Russian wheat production will reach 92.2 mmt in 2024, just below the 92.8 mmt harvested in 2023. Export sales tomorrow are expected to range from 8 – 18 mil. bu.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.