Soybeans, soymeal, soyoil, corn and wheat futures traded sharply lower. Some feel large spec long liquidation was linked to margin calls and that triggered negative tech selling and considered a washout from recent highs. US stocks, Crude and most commodities traded lower on concerns over increase World virus cases could slow global economic recovery.

SOYBEANS

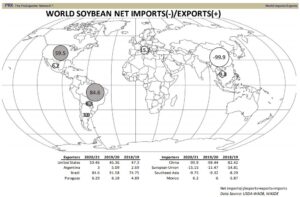

SH closed near 13.11. Most feel this is close to fundamental value. Trade below 13.00 could suggest a test of 12.50. Lower prices should stop any new farmer selling and should increase end user buying. Weekly US soybean export sales were near 1.8 mmt. This was higher than expected. US export commit is near 57.3 mmt versus 31.2 last year. USDA goal is 60.7 mmt versus 45.7 last year. China commit is near 34.4 mmt with 4.6 in unknown. Some feel China could take 38 mt from US. World soybean and soymeal Oct-Dec export were near 40.7 mmt versus 42,4 ly. US soybean exports were 32.9 mmt vs 18.4 ly. Brazil soybean exports were 3.9 mmt vs 13.2 ly. Argentina soymeal exports were 4.9 mmt vs 7.4 last year.

CORN

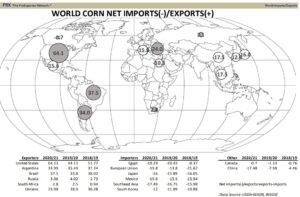

Corn futures trade sharply lower. Meats trade sharply higher. Spec long liquidation on margin calls triggered increase tech selling. CH rejected the 5.40 area and traded back near 5.00. Next support is near 4.95 and 20 day moving average. Lower prices should slow new farmer selling and should increase end user buying. 5.00 should be close to fundamental value. Weekly US ethanol production was up slightly from last week but still down 10 pct from last year. Stocks were down slightly from last week and down almost 2 pct from last year. Margins remain negative. There is still hope that once US consumer is vaccinated demand for fuel/ethanol could increase. Weekly US corn export sales were near 1.4 mmt. This was higher than expected. US export commit is near 46.8 mmt versus 20.3 last year. USDA goal is 64.8 mmt versus 45.1 last year. China commit is near 11.7 mmt with 7.7 in unknown. Some feel China could take 20 mt from US. Argentina raised their corn crop rating but is still well below average. Brazil second corn crop plantings are later than normal. Dalian corn futures traded lower.

WHEAT

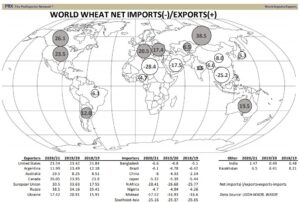

Wheat futures closed sharply lower and followed lower traded in corn and soybeans. WH closed near 6.35 after trading below the 20 day moving average near 6.46. Next support is near 6.17. Some feel 6.00 is near fundamental support. Today’s action should flip Managed funds to a net short. News this week that Russia will not impose and export quota abut will impose export taxes Feb 15 and March 1. Weekly US wheat export sales were near 329 mt. US export commit is near 21.3 mmt versus 20.2 last year. USDA goal is 26.8 mmt versus 26.2 last year. Russia dropped export prices to try to maximize exports before the Feb 15 export tax takes effect. Matif wheat futures followed lower US futures. Talk of increase cases of global virus raised concern about food demand recovery.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.