SOYBEANS

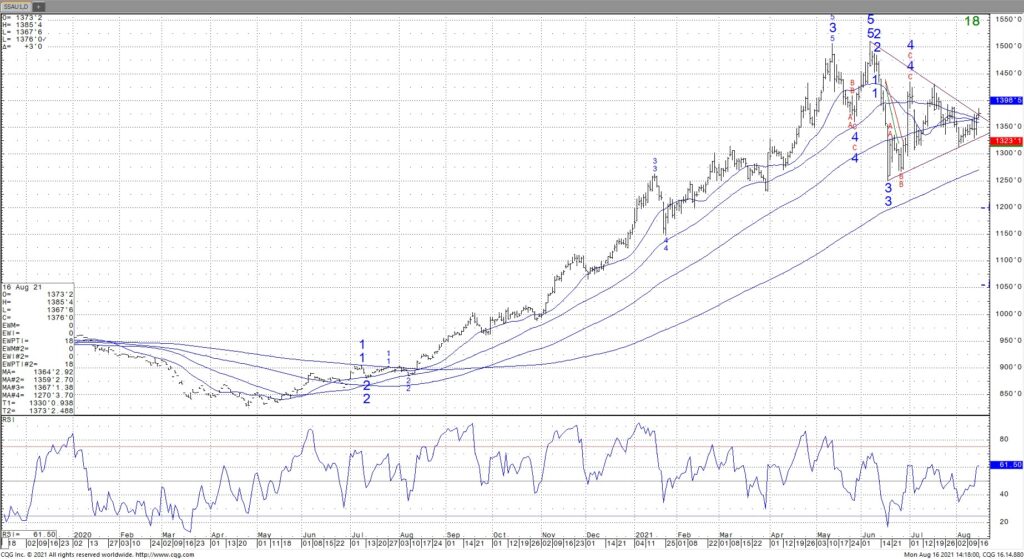

Soybeans edged higher. Soymeal gained on soyoil. Dalian soymeal futures were sharply higher. There is talk that China domestic soybean and soymeal supplies are running low and domestic feeders are looking to add to cash coverage. This has raised talk the China may be asking for US Oct-Nov prices. Weekly US soybean exports were near 277 mt vs 114 last week and 75-300 expected. Season to date exports are 58.6 mmt vs 41.1 ly. USDA goal is 61.5 vs 45.7 ly. USDA est US 21/22 soybean exports at 55.9. US July NOPA soybean crush was 155 mil bu vs 173 last year. This suggest total crush near 164 vs 184 ly. Total crush could be closer to 2,134 mil bu vs USDA 2,155. This could add 20 mil bu to USDA 160 carryout. This could offer resistance to prices. US 2 week Midwest forecast calls for normal rains over parts of the Midwest. SX support is near 13.40. Resistance is 13.88. Eventual trade over 13.88 suggest next target could be 15.71. SMZ support 356. Resistance 378. Talk of lower energy demand weighed on Crude oil prices which offered resistance to soyoil prices. Soyoil support 62. Resistance 65.57.

November soybean futures chart

CORN

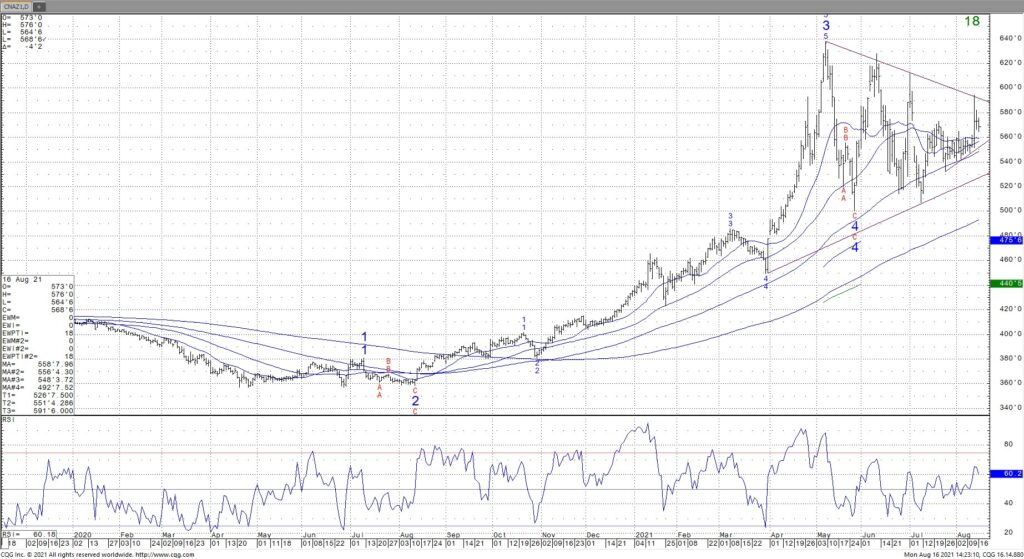

Corn futures ended lower. Talk of lower energy demand weighed on Crude oil, soyoil and corn. Slow weekly US corn exports and approaching US harvest also offered resistance. CZ ended near 5.68 with a range 5.64 to 5.76. Drier US west Midwest offered early support. Corn market continues to struggle with higher prices going into US harvest. Pro Farmer tour is this week. Today, one group is in OH heading for SE MN. Another group is in SD and also heading for SE MN. Historically, Pro Farmer tends to est state corn yield below USDA August est. It will be also important to see when harvest will start state by state. Weekly US corn exports were near 754 mt vs 745 last week and 600-1,000 expected. Season to date exports are 64.3 mmt vs 40.5 ly. USDA goal is 70.5 vs 45.1 ly. USDA est US 21/22 corn exports at 61.0. Trade estimates that weekly US corn crop rating will remain near 64 pct G/E. Most feel USDA corn export guess could be 100-200 mil bu too low. This could put US 2020/21 corn carryout closer to 1,075 mil bu versus USDA 1,117. Some feel final US corn acres could be closer to 94.4 vs USDA 92.7. Key then will be weather going into harvest. CZ is near initial support near 5.68. Resistance is near 5.84. Trade over 5.84 could suggest an eventual trade closer to 6.88. A few could still see a US 2021 corn crop near 14.8 bil and if demand is near 15.0, carryout could drop to only 820 mil bu.

December corn futures chart

WHEAT

Wheat futures ended mixed to lower. WZ ended near 7.75 with a range of 7.71 to 7.84. KWZ ended near 7.49 with a range of 7.47 to 7.61. Overnight. Chicago and KC traded higher on talk of higher EU wheat prices. A reversal in Paris wheat futures from higher to lower weighed on US futures. There remains concern over demand for US wheat export. Weekly US wheat exports were near 440 mt vs 653 last week and 300-625 expected. Season to date exports are 4.8 mmt vs 5.6 ly. USDA goal is 23.8 vs 27.0 ly. USDA

est World trade near 198 mmt vs 201 ly. EU is 35 mmt vs 38.5 ly, Russia 35 vs 38.5 ly, Ukraine 23.5 vs 16.7 ly, Canada 17.5 vs 27.5 ly, Australia 22.0 vs 23 ly. WZ support 7.63. Resistance is 8.00.

Nearby Dec KC wheat futures spread minus Chicago Dec corn

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.