London Wheat Report

After yesterday’s stray into the green, it looks as through strong buying is keeping prices from sliding too much further. Underpinned by strong supply from the likes of Egypt (reportedly buying 770,000 metric tonnes of primarily Russian wheat), it looks as though the past weeks’ price drops could be near their completion. However, ample world supplies and discussions afoot pushing for the relaxation of the Russian grain price floor will no doubt limit the upside price potential as northern hemisphere harvests progress.

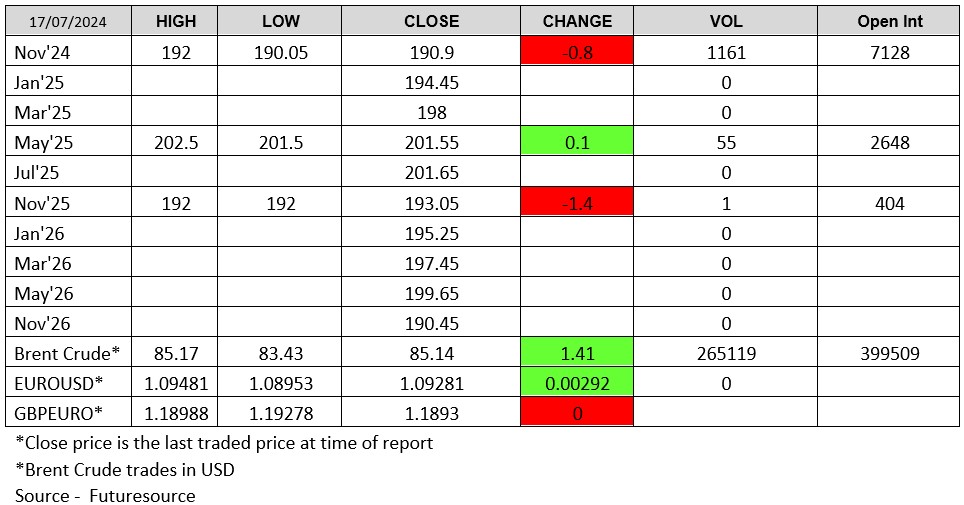

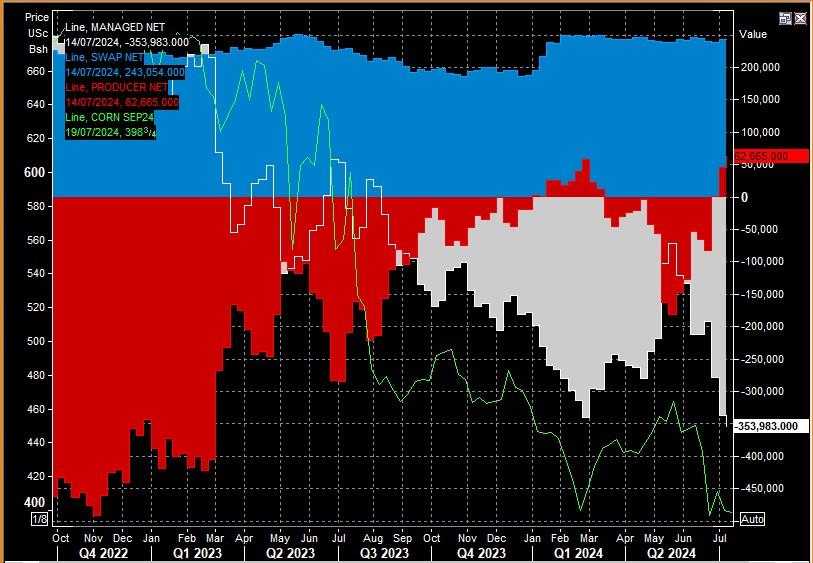

Corn future prices have also experienced similar strengthening on the back of “bargain-buying” whilst today saw soybeans dropping back down into the red. US soybeans in particular are allegedly the world’s most cheap and oversold commodity. This title has been generated in no small part by vast fund short positions with corn in a similar position depicted in the graph below.

Source: Refinitive

Closer to home, the German Association of Farm Cooperatives stated that the country’s wheat output will reduce by 6.2% down to 20.2mnt – continuing the story of crop reduction estimates that we have seen time again this year. Their gloomy view on output was also applied to rapeseed which is reportedly 10.0% down from last summer’s crop (meaning a harvest potential of 3.8mnt). Revisions in harvest estimates are largely down to wet weather that has hammered western Europe for the past 10 months. As the combines start rolling across the continent, dry weather is imperative to prevent yet more reductions in output.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.