Soybeans, soymeal, corn and wheat traded higher. US stocks were mixed. US Dollar traded lower. Crude was mixed. Gold traded higher.

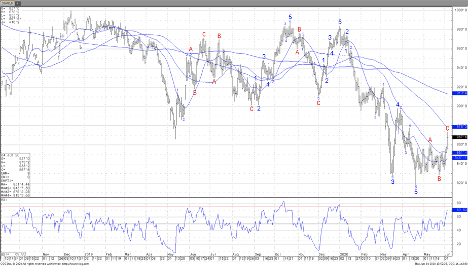

SOYBEANS

Managed funds were large net buyers of soybeans. Some link this to continued small US soybean sales to China and fact US export prices are a discount to Brazil. Funds are covering large soymeal short position. Lower palmoil and soyoil prices might be triggering spread liquidation. Argentina soymeal prices are still a discount to US. US domestic soymeal demand remains slow. Weekly US soybean export sales were near 18 mil bu. Total commit is near 1,567 mil bu versus 1,715 last year. Recent China buying US soybean has been near 190 mt old crop and 510 mt new crop. Informa left South America soybean crop numbers unchanged from last month. Fact India announced that they will import 50 pct less palmoil due to the virus weighed on palmoil and soyoil prices. US farmer increased cash sales today. Most look for Weekly US soybean crop ratings to increase 1-2 pct.

July soybean futures chart

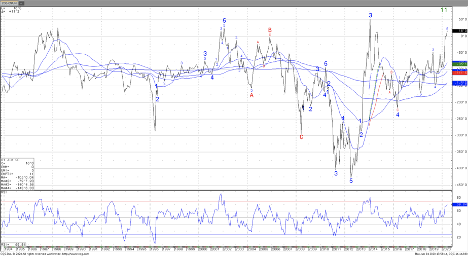

CORN

Corn futures traded higher. Managed funds were small net buyers of futures linked to short covering. Some feel corn was a follower to higher soybean, soymeal and wheat prices. Corn futures are near the upper end of the recent trading range. US 2 week Midwest weather forecast starts warm and dry. Tropical storm in US Gulf could bring rains and cooler Midwest temps. This should be ideal for US summer crops. Oat and rice futures continue to trade higher. Record demand at US groceries during the spread of the virus has increase demand and prices. There is plenty of global rice supply but there has been some export disruption due to the virus. Talk of tight US commercial rice holding and some that are short rice call options continues to support July rice futures. The demand for rice and oats is not expected to help corn or wheat demand. Weekly US corn export sales were near 25 mil bu. Total commit is near 1,593 mil bu versus 1,899 last year. South America prices are lower than US. Drop in ethanol demand is expected to increase US carryout and weigh on prices. Analyst suggest selling cash corn on this rally. Informa dropped Brazil corn crop 4 mmt and raised slightly Russia and Ukraine crops. US farmer remains a reluctant sellers of cash corn. Most look for USDA corn rating to increase 1-2 pct. Some feel final US corn yield could be closer to 186.0

Monthly nearby oats futures minus corn futures spread

WHEAT

Wheat futures traded higher. Some link the buying to higher Russian export prices. Russia export prices are now near $207. Higher domestic Russia wheat prices and slow farmer selling has tighten Russia old crop supplies. Informa dropped EU wheat crop 3 mmt and Russia crop 5 mmt. Lower EU crop helped French wheat futures rally. This also supported prices. Informa raised China 3 mt and India 1.4 mmt. Informa also estimated US 2020 all Wheat crop near 1,892 mil bu versus USDA 1,866 and 1,902 last year. HRW crop was estimated near 732 mil bu versus 833 last year. SRW was estimated near 297 mil bu versus 239 last year. HRS crop was estimated near 543 mil bu versus 522 last year. Dry and warm US south plains weather could also be helping KC wheat futures. Weekly US wheat export sales were near 6 mil bu. Total commit is near 990 mil bu versus 949 last year. US farmer increased cash sales on todays rally.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.