SOYBEANS

Soybeans and soymeal traded lower. China soybean and soymeal prices traded lower. Slow weekly US soybean export sales and rains across the US central Midwest offered resistance to soybeans. Lower Argentina prices, slow US domestic demand and weak China prices weighed on soymeal. Soyoil found

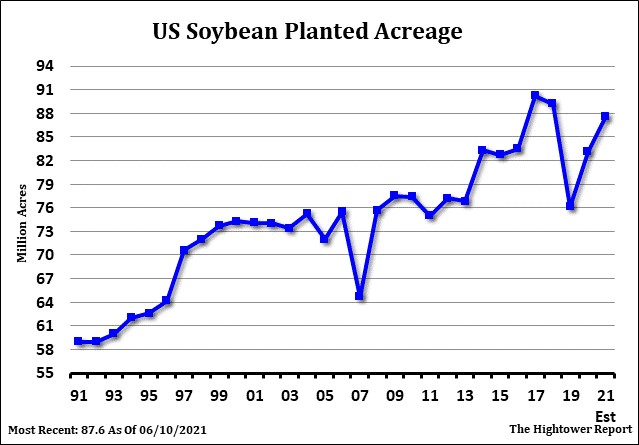

Support of soyoil minus soymeal spreading and higher Canola prices. Bloomberg reports that the trade is looking for 89.1 million soybean acres vs USDA 87.6. Range was 88.0-90.6. One group today estimated US soybean acres at 86.5. Survey also estimated US June 1 soybean stocks near 773 mil bu vs 1,381 ly.

Weekly US soybean export sales were near 5 mil bu. Total commit is near 2,269 mil bu vs 1,638 ly. USDA goal is 2,280 vs 1,682 last year. China has shipped 1,284 mil bu with total commit near 1,310. China has 110 new crop sales with some looking for them to buy a total of 1,465 from US next year.

CORN

Corn futures ended lower. July lost some of its premium before Friday option expiration. Corn saw continued fund selling as rains move across the central Midwest. Forecast suggest the central Midwest could see 4.00-5.00 inches of rain. Some isolated locations in MO and IL could see as much as 10.00.

Corn found support on rumors that a few groups could see less corn acres increase on USDA June 30 report than what is being traded. There has been unconfirmed rumors that Informa may drop their corn acreage est from 96.5 to 94.3. One farm group surveyed their farmers that account for 4.2 mil crop

acres and est US corn acres a 92.9. USDA are currently est corn acres near 91.1 vs 90.8 ly. Bloomberg survey est acres at 93.8 with a range of 92.0-95.8. There was also one fundamental corn bull that est US 2021/21 corn carryout near 825 mil bu vs USDA 1,107. Their export number is 3,050 vs USDA 2,850.

They est US 2021 corn acres near 93.0 and yield of 179.5 suggest a carryout of 675 vs USDA 1,357 and exports near 3,050 vs USDA 2,450. Weekly US corn export sales were near 8 mil bu. Total commit is near 2,737 mil bu vs 1,651 ly. USDA goal is 2,850 vs 1,778 last year. China has shipped 665 mil bu with total commit near 920. China has 420 new crop sales with some looking for them to buy a total of 1,180 from US next year.

WHEAT

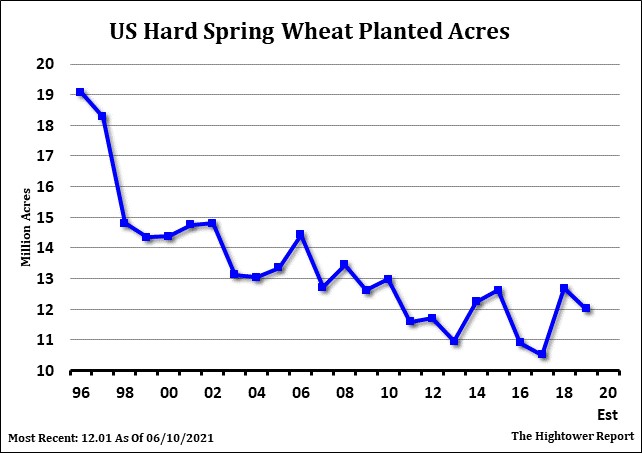

Wheat futures closed mixed. US winter wheat harvest and lower corn prices continued to weigh on Chicago and KC futures. US weekly wheat export sales were 13 mil bu. Total commit is near 227 mil bu vs 249 ly USDA goal is 900 mil bu vs 985 ly. Bloomberg survey est US 2021 all Wheat acres near 46.0 vs 46.4 in March. Range is 45.0-46.9. Survey also estimated US June 1 wheat stocks near 861 mil bu vs 1,028 ly. The 2 week US north plains weather forecast call for continued net drying and warmer than normal temps. Some were beginning to compare 2021 HRS weather to 1988 when ND farmers harvested only 75 pct of planted acres and final yield of 15. Some are even talking about farmers harvesting 50 pct of the acres with a yield of 30. HRW harvest report above average yield and below average protein.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.