TODAY—WEEKLY ETHANOL STATS—

Overnight trade has SRW Wheat up roughly 2 cents, HRW up 3; HRS Wheat up 4, Corn is up 17 cents; Soybeans up 3; Soymeal down $2.50, and Soyoil up 20 points.

Chinese Ag futures (May) settled up 8 yuan in soybeans, up 48 in Corn, up 104 in Soymeal, up 20 in Soyoil, and down 20 in Palm Oil.

Malaysian palm oil prices were down 6 ringgit at 3,689 (basis March) on trade positioning.

Conditions will still be very good in much of Brazil. Some pockets of the far south may still become drier than preferred in the second week of the outlook; though, a notable rain event this weekend will support the needs of crops in this part of the nation for a while with the possible exception of a few areas in southern Rio Grande do Sul.

A notable rain event is still expected to impact central and northern Argentina Friday into Saturday due to a frontal boundary. The rain will be important due to the lengthy period of dryness that is still expected to follow it.

The player sheet had funds net buyers of 25,000 SRW Wheat; bought 58,000 Corn; net bought 33,000 Soybeans; bought 13,000 lots of Soymeal, and; bought 1,000 lots of Soyoil.

We estimate Managed Money net long 36,000 contracts of SRW Wheat; long 378,000 Corn; net long 226,000 Soybeans; net long 109,000 lots of Soymeal, and; long 107,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 6,400 contracts; HRW Wheat down 560; Corn up 39,100; Soybeans up 2,000 contracts; Soymeal down 1,700 lots, and; Soyoil up 1,900.

Deliveries were ZERO Soymeal; ZERO Soyoil; Rice 1; and 11 Soybeans.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 131; Soyoil 1,289 lots; Soymeal 175; Rice 671; HRW Wheat 91, and; HRS 1,023.

Tender Activity—S. Korea seeks 66,000t optional-origin corn—

Wire story had a report that anyone looking for fireworks following the U.S. Department of Agriculture’s Tuesday forecasts was not at all disappointed, but for most market participants, the recent trend in some of the numbers might be downright unsettling. The U.S. corn figures were the most surprising in the data landslide published by USDA on Tuesday, particularly for quarterly stocks and 2020 crop yield. Both of those numbers fell considerably below the trade range of estimates, which were historically wide for yield. That locked most-actively traded Chicago corn futures up the daily 25 cents per bushel limit at $5.17-1/4 where it finished the session, and traders reported the contract was trading synthetically through options up another 8 cents. That would make for the highest price in the most-active contract since July 2013.

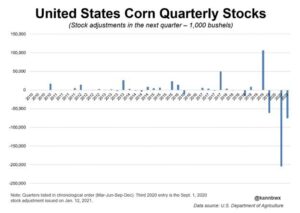

Quarterly U.S. corn stocks seem to be getting harder to predict, and that appears largely driven by revisions to the previous quarter’s stocks, which is part of USDA’s standard procedure. But the revisions are getting larger, setting up even more uncertainty for future reports.

As expected, U.S. corn exports increased to 4.4 million tons in December, the highest volume compared to the same period of the past 5 years. China continued to be the top U.S. corn importer, accounting for 1.6 million tons of total December shipments. Meanwhile exports to other destinations (besides China) increased by 15% from a month ago to 2.8 million tons. Accumulated corn exports during September-December totaled 15.1 million tons, up 6.6 million tons from last year’s same period. Among them, exports to China totaled 5.1 million tons, compared to 0.06 for last year. U.S. corn sales continue to be strong amid increasing demands, tight global supply concerns, and depreciation of U.S. currency. According to USDA’s export sales data, outstanding sales as of 31 December totaled 28.7 million tons, well above last year’s 9.6 million tons and 13.8 million tons for the 5-year average.

Spot millfeed values stayed firm on Tuesday in truck and rail markets around the United States due to strong demand for animal feed, brokers said.

* Feed costs are rising as tightening estimates for U.S. crop supplies are pushing up corn, soy and wheat prices.

* Wheat-based millfeeds compete with corn for space in feed rations.

* The U.S. Department of Agriculture raised its 2020/21 estimate for wheat used for feed and residual purposes to 125 million bushels, from 100 million last month. If achieved, that would be the most since 2016/17.

BRAZIL CORN EXPORTS SEEN REACHING 2.121 MILLION TNS (NOT 1.175 MILLION TNS) IN JANUARY VERSUS 1.174 MILLION TNS FORECAST IN SAME MONTH OF 2020 – ANEC

BRAZIL SOY EXPORTS SEEN REACHING 1.052 MILLION TNS IN JANUARY VERSUS 1.669 MILLION TNS IN SAME MONTH OF 2020 – ANEC

Argentina said on Tuesday it lifted a 30,000-tonne-per-day limit recently placed on corn exports, which had caused farmers to go on a sales strike in protest. Growers have withheld crops from market since early Monday, angered by what they said was overzealous intervention in the markets. The government said the curb was intended to ensure ample domestic food supplies and stable prices. As part of a deal negotiated with farm groups and export companies on Tuesday, the agriculture ministry said a commission would be named to monitor domestic corn prices.

The duty on the export of sunflower seeds from Russia in 2021 will be increased. This measure will help keep prices down on the country’s domestic market. The corresponding legislative changes come into force on January 10. Export duties on sunflower and rapeseed seeds from Russia will rise to 30 percent from January 2021.

Exports of wheat from Ukraine in 2020 amounted to 16.06 million tonnes for $3.595 billion, which is respectively 9.8% and 1.8% less than a year earlier, the State Customs Service of Ukraine said on Tuesday. According to its data, corn was exported in amount of 27.95 million tonnes for $4.88 billion, which is lower than the indicators of 2019 by 13.6% and 6.4%, respectively.

Several Ukrainian Black Sea ports have restricted grain cargo operations due to poor weather conditions, the state-run Ukrainian sea port authority said.

Ukrainian livestock and poultry producers’ associations have asked the government to limit corn exports in the 2020/21 season to 22 million tonnes to avoid a shortage of animal feed, analyst APK-Inform said. Ukraine’s corn harvest fell to around 29.3 million tonnes in 2020 from 35.9 million a year earlier and producers fear large-scale corn exports could sharply reduce grain stocks and raise corn prices. Ukraine has exported 9.7 million tonnes of corn so far this season, 2.6 million tonnes less than in the same period a season ago. If this volume (of 22 million tonnes) is exceeded, temporary restrictions on corn exports should be imposed to ensure domestic consumption in the volumes necessary to preserve animal husbandry.

Indonesia plans to import 2.6 million tonnes of soybeans this year, the head of the country’s food security agency at the agriculture ministry

Malaysia maintained 8% export tax on crude palm oil in February; the government set a reference price of 3,657.67 ringgit ($904.13) per ton for next month, Malaysian Palm Oil Board said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.